Chase Bank, JPMorgan Chase & Co.'s consumer banking arm, is one of the nation's largest full-service banks. It offers a broad range of financial products and services to individuals and businesses. In addition to checking, savings and CD accounts, Chase is well known for its extensive credit card offerings, including popular travel rewards and cash back credit cards. With options for adults, students and kids, Chase has accounts to fit most needs. With Chase business checking, your business can process debit card purchases and credit card purchases conveniently using the QuickAccept service through the Chase Mobile app.

And you can enjoy this benefit without filling out any additional applications. Just remember, processing credit cards or debit cards isn't free. You will pay additional fees for each transaction whenever your business accepts electronic payments, just like you'd expect to pay with a traditional merchant account. Chase labels three of its checking accounts as "everyday" checking accounts. All three accounts offer access to nearly 16,000 ATMs and more than 4,700 branches nationwide. Each account offers online banking, online bill pay and mobile banking, as well as automatic transfers to Chase savings accounts.

The Chase Total Checking® account offers a $225 bonus for new customers and a top-rated mobile app that makes banking easy. With both physical and online banking options, you can tailor your experience to your needs. Chase Total Checking ranks on our list of best checking account bonuses of 2021 because, in addition to the signing bonus, there is no minimum balance requirement to open a new account. Chase serves more than 50 million consumers and 4 million small businesses through more than 5,500 bank branches, 18,000 ATMs, credit cards, mortgage offices, and online and mobile banking.

One of the better offerings from the banking giant is Chase College Checking. The account is designed for college students ages 17 to 24. There is no monthly service fee for college students for up to five years while you attend school, provided you show proof of your student status.

The account comes with a free debit card and account access online and through Chase's mobile app. Chase maintains a strong digital footprint with its popular mobile app and online banking platform. Yet, it still offers an extensive local presence for individuals who prefer in-person banking services.

If you can avoid the monthly fees, Chase is a solid option for your personal banking needs. You'll have until the end of the business day/cutoff time to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions. There's a three-per-day maximum for these fees (totaling $102), and they don't apply to withdrawals made at an ATM. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P.

Morgan Securities LLC , a registered broker-dealer and investment advisor, member of FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A.

JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. • Some features are available for eligible customers and accounts only. Any time you review your balance, keep in mind it may not reflect all transactions including recent debit card transactions or checks you have written. A qualifying Chase transfer account is required to transfer funds via text.

JPMorgan Chase Bank, N.A.and its affiliates (collectively "JPMCB") offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered throughJ.P. Morgan Securities LLC("JPMS"), a member ofFINRAandSIPC.

JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Please read theLegal Disclaimerin conjunction with these pages. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Morgan Securities LLC , a registered broker-dealer and investment advisor, memberFINRA and SIPC. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll.

Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Through new functionality on Chase.com/espanol, the bank now offers a comprehensive Spanish online banking option to customers. Chase has over 54 million digitally active and 39 million mobile active customers.

To learn more, including videos on how it works, visit Chase.com/FirstBanking starting today, or visit a Chase branch. In addition to Chase First Banking, the bank also offers checking and savings accounts for high school and college-aged youth. Note that Chase may report your bank bonuses to the IRS via Form 1099-MISC since they are considered to be miscellaneous income. At the moment, Refer-A-Friend bonuses are not available to those opening new Chase business checking accounts. However, if Chase Bank is your credit card issuer, you may be eligible to earn additional credit card referral bonuses — both on the business and personal side.

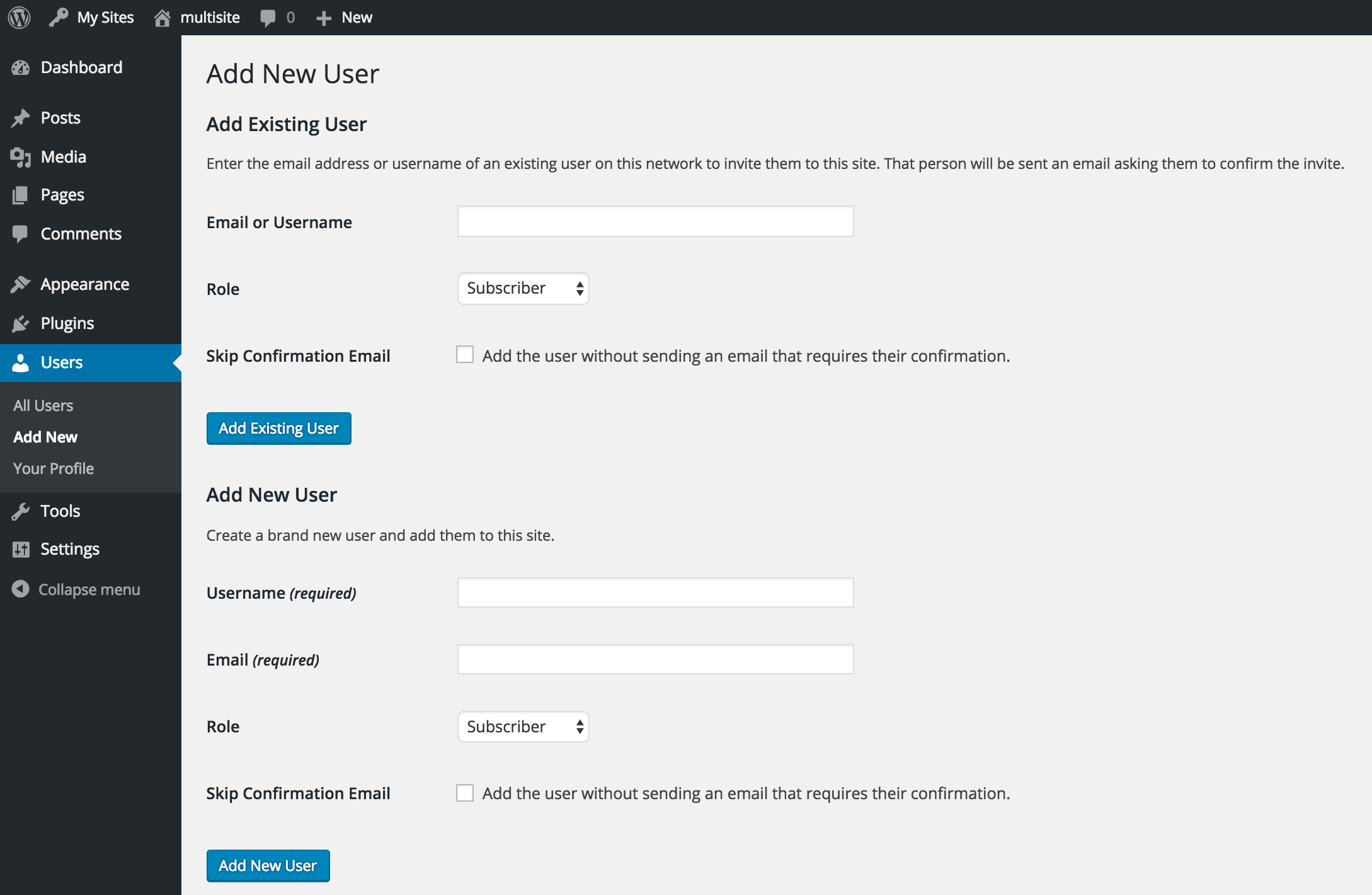

Chase Bank offers a robust selection of checking accounts to meet varying banking needs. Like its savings accounts, most of Chase's checking accounts feature a monthly service fee. Chase generally offers ways to waive these fees, though. Can I edit or delete a pending payment or transfer in online banking?

In online banking, upcoming activity is displayed in the account details page of each account. Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon. Select the payment you wish to cancel in the Bill Payments menu. Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit.

Please review its terms, privacy and security policies to see how they apply to you. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. More convenient than cash and checks — money is deducted right from your business checking account.

Make deposits and withdrawals at the ATM with yourbusiness debit card. Chase isn't responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback.

Chase.com/espanol originally launched in 2008, offering customers information on Chase's portfolio of products and services. In addition to business banking, Chase also haspersonal banking options and investment accountsavailable as well, if you prefer to house all of your banking needs under one roof. Some banks require you to wait before you can access the funds that you deposit into your business checking account. That's not the case with Chase Business Complete Banking.

Chase offers your business same-day deposits using its QuickAccept service, and it does so without charging you any additional maintenance fees for the benefit. Finally, be on the lookout to see if the offer comes with an expiration date, along with how many business days it takes to receive bank bonuses once you qualify. It is worth noting that this $300 Chase business checking bonus isn't the most generous bonus offer we've seen from Chase.

In the past, the bank has offered a $500 new account bonus to qualifying customers who opened other Chase business deposit accounts. Yet as far as current business bank bonuses are concerned, a $300 bonus for Business Complete Checking is still very attractive. And, if you already need to open a new business checking account anyway, it's a nice added perk.

If you haven't set up a dedicated business bank account yet, or if you're in the market for a new one, a Chase Business Complete Checking account is worth your consideration. But you should be aware that those same monthly service fees can be as high as $15, depending on how you use the account. On a more attractive note, if you're willing and able to complete a few qualifying activities, you could wind up enjoying a $300 bonus when you open a new Chase business checking account. If you're enrolling in mobile and online banking to access your business accounts, you'll need an ATM or debit card.

You can apply for these at a branch and use your PIN to log in to mobile or online banking. Next, create a unique username and password to log in securely in the future. In online banking, you will first need to add an account.

From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers. You can set up same day/future dated/recurring transfers in either online banking or the mobile app. Open a Chase College Checking℠ account online or in a branch.

Complete at least 10 qualifying transactions (including debit card purchases, online bill payments and deposits using Chase QuickDeposit℠) within 60 days of opening your account. The account must remain open for six months, or Chase may deduct the bonus at closing. You're allowed to receive one bonus that's related to opening a new checking account every two years, and you can only receive one bonus per account. /PRNewswire/ -- Parents and kids now have a way to help them manage allowances, complete and check off chores, monitor spending, and save towards a goal.

Same-Day Deposits are available to eligible merchants of software platforms with a 5 PM PT cut-off time for payments processed on WePay. Merchants must deposit into a single Chase bank account. All transactions are subject to WePay terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays.

Funds are deposited on business days, excluding weekends and bank holidays. Chase is a nationwide bank that offers a wide range of other financial products, private client options and services, including loans, credit cards and investments such as You Invest by J.P. Daphne Foreman is the Banking and Personal Finance Analyst for Forbes Advisor. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing. As a small business owner and former financial advisor, Daphne has first-hand experience with the challenges individuals face in making smart financial choices. Eligible accounts for linking to KeyBank online and mobile banking include checking, savings, credit cards, loans and investments.

There isn't a maximum number of accounts you can link. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

Your earnings depend on any associated fees and the balance you have in your checking account. To open an account, some banks and institutions may require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. To determine which checking accounts provide the best place to deposit your money and earn a bonus, Select analyzed dozens ofU.S. Checking accountsoffered by online and brick-and-mortar banks, including major credit unions. We narrowed down our rankings by only considering checking accounts that have bonuses available to new applicants.

Chase offers a wide variety of business checking accounts for small, mid-sized and large businesses. Compare our business checking solutions and find the right checking account for you. Business owners and entrepreneurs can also opt to open a business savings account with Chase.

A business savings account can be a great place to stash away extra cash reserves or to save money toward a business goal. It can also serve as added protection against business checking overdrafts and their associated costs. All links in our content provide compensation to Slickdeals. That's why we offer useful tools to evaluate these offers to meet your personal objectives. Be sure to verify all terms and conditions of any credit card before applying.

Chase Bank offers ample banking products to meet the needs of most individuals. Still, low interest rates keep it from being a viable option for people who want to maximize their savings. Monthly service fees are also an issue for those who don't want to pay for banking services, although most fees can be waived if you can meet specific monthly requirements. Our online banking security uses advanced encryption and monitoring technology to ensure your money stays safe and secure. And to keep your personal information confidential, we have strict policies and procedures in place. Only you have access to your accounts with your username and password.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.